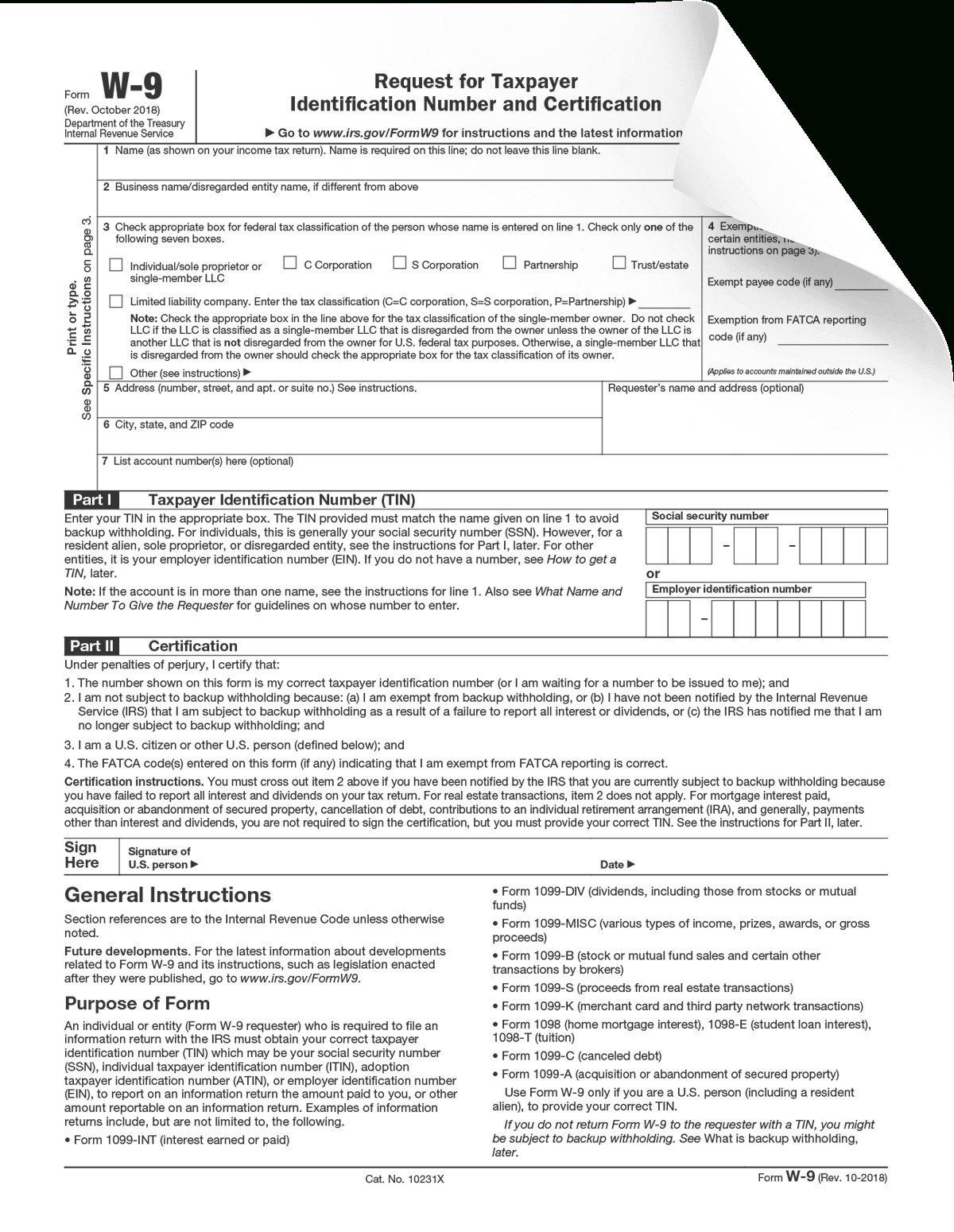

Your Taxpayer Identification Number (“TIN”) is either your Social Security Number (SSN), Individual Tax Identification Number (ITIN) or your Employer Identification Number (EIN). Tax ID numberĮnter on Line 3 the Taxpayer Identification Number (“TIN”) matching the name of the person entered on Line 1 who should receive the Form 1099 for Host earnings. If you operate as a sole proprietorship, you may enter the name of your sole proprietorship here, but enter your individual name in the “Name” field above. Individuals who hold their hosted property in their own name should leave this line blank. Generally, single member LLCs and Grantor trusts should write in their name here providing the name of their owner on Line 1 as described above. If you have a business name, trade name, DBA name, or a disregarded entity name fill it in here.

#W9 form 2021 full

Corporation – Write the full legal name of the corporation.Partnership – Write the full legal name of the partnership.For other types of Trusts, please refer to the Form W-9 instructions on page 6 here. Trust: If the trust is a ‘grantor trust’, enter the full legal name of the owner of the trust as it appears on that person’s tax return.If the Single Member LLC has elected to be treated as a corporation with IRS, enter the name of the Single Member LLC.If the owner is an entity provide the full legal name of the entity owner as it appears on the owner’s tax return.If the owner is an individual, then that individual should list their name, and complete and sign the Form W-9.Single-member LLCs: Generally, provide the name of the owner of the Single Member LLC in Line 1:.Individuals: Enter your full legal name as it appears on your tax return.Get information on allocating payments between different accounts.Įnter the name of the person who should receive a Form 1099 for Host earnings. persons) will correspondingly be needed for each payout account. Separate Forms W-9 (assuming all payout beneficiaries are U.S. Note: If you are allocating Host earnings to different payout accounts, then individual Forms 1099 will need to be issued for each payout account.

Only 1 tax form can be assigned to each payout, so it is critical your Form W-9 identifies the correct person/entity responsible for the tax reporting.

We view the payout beneficiary associated with the payout method on your account as the person or business we will issue a Form 1099 to, which will also be filed with the IRS and/or state as applicable to report Host earnings. The tax information provided on this form should correspond to the person (including a legal entity) that we will issue a Form 1099 to report Host earnings 2. If we do not receive one from you, we may be required to withhold tax from your earnings as a Host. Form W-9 (Substitute)-Request for Taxpayer Identification Number and Certification: We use this simplified “substitute” version of an IRS Form W-9 to collect your Taxpayer Identification Number for U.S.

0 kommentar(er)

0 kommentar(er)